Blog

Keep updated with recent real estate news.

5 Best Neighborhoods to Invest in Los Angeles Real Estate in 2026

Many neighborhoods in Los Angeles have already become too expensive for new investors. Prices climbed fast, and that makes it tough to find properties that still have room for growth. But certain areas haven’t hit their peak yet. They still offer good opportunities if you choose carefully.

This blog post covers five neighborhoods that make sense for investors right now. Each neighborhood has practical zoning rules that allow more building. Each one also has solid transit options nearby, which helps renters and buyers decide to move there. Rental demand is rising steadily in these areas. Some still have empty or underused lots you can actually build on, without getting stuck in complicated city processes.

The goal here is to show you areas where the numbers still work. No hype or guessing about the future, just neighborhoods that have the right conditions in place for investment today and into 2026.

Silverlake

Silver Lake has long been a cultural touchstone in Los Angeles home to indie film studios, street art, coffeehouse musicians, and a fiercely loyal creative class. Its mix of mid-century modern homes, Spanish Revival bungalows, and walkable urban streetscapes makes it a magnet for young professionals, artists, and remote workers seeking both inspiration and lifestyle.

Beyond its aesthetic appeal, Silver Lake is a high-performing investment market. Median household incomes here exceed city averages, reflecting a resident base with strong spending power and rental reliability. Housing demand remains intense, with competition for both rental units and fixer-uppers driving consistent appreciation. Over the past few years, rent growth has surged by 25–26%, signaling a healthy, high-demand rental market that continues to outperform many other parts of the city.

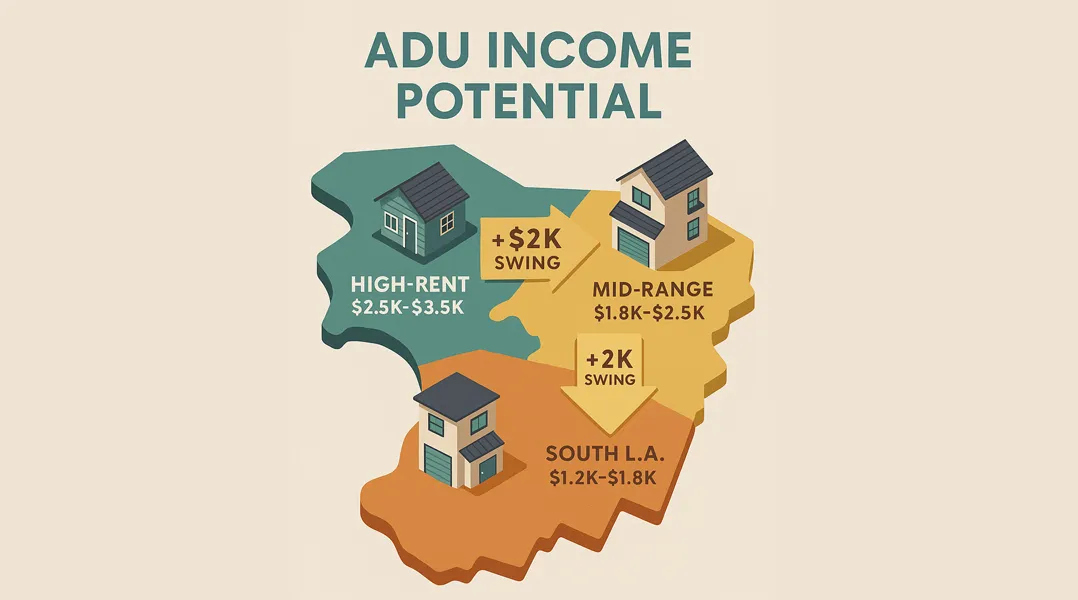

Whether you’re investing in a multi-family property, adding an ADU, or seeking long-term appreciation through a value-add strategy, Silver Lake offers a compelling mix of cultural cachet and financial upside. Its proximity to Downtown, Hollywood, and Echo Park only strengthens its appeal for both tenants and future buyers.

Echo Park

Echo Park blends natural beauty with urban energy offering scenic views of its iconic reservoir, lush hillsides, and unbeatable proximity to Downtown Los Angeles. Once known primarily for its bohemian roots and punk music scene, the neighborhood has transformed over the past decade into one of LA’s most sought-after areas for both renters and investors.

What makes Echo Park particularly attractive is its rare mix of character and upside. The post-pandemic era saw a dramatic rent spike up nearly 75% as demand surged for homes in centrally located, walkable neighborhoods with unique charm. This rapid growth has captured investor attention, especially as many buyers were priced out of adjacent Silver Lake or Los Feliz. (RentCafe)

With strong rental yields, a diverse housing stock (from Craftsman homes to sleek new ADUs), and steady appreciation, Echo Park stands out as a high-performance investment zone. Whether you’re targeting short-term rental income or long-term equity growth, this neighborhood checks every box: location, lifestyle, and momentum.

West Adams

West Adams is one of Los Angeles’ most exciting frontiers for value-add real estate investors. With its abundance of early 20th-century Craftsman and Tudor-style homes, the neighborhood offers a unique blend of architectural character and redevelopment potential that’s hard to find elsewhere in the city. (Wikipedia)

Once overlooked, West Adams has undergone a dramatic transformation in recent years becoming the most volatile and fastest-growing residential market in L.A. County. From 2016 to 2024, home values in the area surged approximately 107%, driven by investor demand, proximity to transit corridors, and broader Westside spillover effects. (xtown) This explosive growth outpaces nearly every other LA neighborhood, capturing the attention of both flippers and long-term buy-and-hold investors.

A major contributor to West Adams’ momentum is its increasing zoning flexibility. The neighborhood has seen a rise in lot splits, small lot subdivisions, and ADU development enabled by progressive local ordinances and regional housing incentives (SB-9). (With developers actively rehabbing older properties and building modern infill housing, the landscape is rapidly evolving without losing its historic soul.

Add in West Adams’ strategic location bordering Culver City, Mid-City, and the Expo Line and it’s clear why the area is under redevelopment pressure and ripe with opportunity. Investors looking for appreciation potential, redevelopment plays, or long-term rental yield in a culturally vibrant neighborhood should keep West Adams at the top of their list.

Glassell Park

Glassell Park is another neighborhood worth paying attention to. It’s right next to Highland Park, where prices have already gone way up. People who got priced out of Highland Park and Eagle Rock are starting to move here. And because of the LA River revitalization project nearby, more interest and investment are likely to follow.

Investors here have straightforward options. The zoning rules let you split larger lots or add ADUs behind existing houses. It’s also practical to turn single-family homes into small apartment buildings. Many of these projects aren’t complicated and don’t involve tough city approvals.

Transit options in Glassell Park aren’t perfect, but the location is convenient enough for renters who work in Northeast LA or downtown. Prices are still lower than surrounding areas, and the neighborhood is steadily drawing new residents. That makes it a practical spot to invest now, before values move closer to the levels seen in neighboring communities.

Atwater Village

Tucked between the artistic energy of Silver Lake and the fast-rising scene in Highland Park, Atwater Village has quietly become one of Los Angeles’ most desirable neighborhoods for buyers, renters, and investors alike. With its walkable streets, preserved Spanish-style bungalows, and a growing roster of boutique shops and cafes, Atwater offers a rare mix of community charm and long-term growth potential.

The neighborhood’s transformation has been steady but significant. A new generation of creatives and professionals has brought fresh life to Atwater’s retail corridors, particularly along Glendale Boulevard and Los Feliz Boulevard now lined with artisan coffee shops, vintage stores, and chef-driven restaurants (LA Times).

Home prices reflect this evolution. As of mid?2025, Zillow reports the average home value in Atwater Village at approximately $1.316 million, showing a modest year-over-year increase of +0.9% despite broader market cooling (Zillow). Meanwhile, Redfin’s data from June 2025 puts the median home sale price at around $1.46 million, with listings still moving relatively quickly, a signal that buyer demand in the area remains resilient (RedFin).

The rental market has also stayed strong. According to RentCafe, the average rent in Atwater Village is about $2,499/month, making it competitively priced compared to nearby Eastside neighborhoods like Echo Park and Silver Lake (RentCafe).

What truly distinguishes Atwater, however, is its livability. The area scores high on walkability and offers direct access to the Los Angeles River bike path, Griffith Park, and Frogtown making it especially attractive to outdoor enthusiasts, families, and remote workers looking for balance.

Atwater Village may not be as loud in the headlines as some of its neighbors, but it’s exactly that quiet consistency that makes it so promising. For investors, it represents a stable, appreciating market with strong community roots, high rental demand, and room to grow without the oversaturation seen in some of LA’s trendier enclaves.

Comparing the Neighborhoods: Which LA Spot Is Right for Your Investment?

Each of Los Angeles’ rising neighborhoods tells a different story and choosing the right one depends on your investment strategy, risk tolerance, and the kind of tenant or buyer you want to attract. Let’s take a closer look at how Silver Lake, Echo Park, West Adams, Glassell Park, and Atwater Village stack up.

Silver Lake: For Established Value with Creative Cachet

Silver Lake remains a top choice for investors seeking long-term appreciation in a neighborhood that’s already arrived. With a strong renter base of professionals and creatives, limited inventory, and consistent rent growth, it’s ideal for those looking for stability with premium buy-in. The market is competitive, but the returns are dependable.

Echo Park: For High Yield & Cultural Energy

Just west of Downtown, Echo Park is the more energetic, evolving sibling to Silver Lake. Its rental demand surged in the post-pandemic years, making it a hotbed for multi-family income and value-add plays. Investors who want a blend of character and cash flow will find plenty of upside here particularly with ADU or short-term rental potential.

West Adams: For Rapid Appreciation & Redevelopment

West Adams is arguably the most dynamic of the five offering both volatility and massive upside. Its 107% home value growth from 2016 to 2024 speaks volumes. With zoning reforms and lot-split legislation reshaping the area, this is the neighborhood for investors ready to get their hands dirty: think flips, infill builds, or mid-term rentals in restored historic homes.

Glassell Park: For Early Entry & Hillside Charm

For those who missed out on Silver Lake a decade ago, Glassell Park may feel like déjà vu. This hillside enclave is still flying a bit under the radar, but not for long. With proximity to the LA River revitalization and a mix of single-family homes and quirky duplexes, it’s ripe for early movers. Rental demand is growing, and prices are still relatively accessible.

Atwater Village: For Walkability & Long-Term Stability

Atwater offers a slower burn, but one with lasting glow. It’s not flashy, but it’s deeply livable: walkable streets, strong community vibes, and proximity to both the Eastside and major green spaces. Investors seeking low turnover, solid tenants, and long-term property value should take note. It’s the kind of place where tenants stay for years and values rise quietly.

Final Thoughts

As Los Angeles continues to evolve, smart investors know that neighborhood nuance is everything. Whether you’re chasing cash flow, long-term appreciation, or a unique slice of city life, the five neighborhoods we’ve covered offer a roadmap to diverse, high-potential investment strategies in 2026 and beyond.

The city’s growth isn’t just happening, it’s being shaped by zoning changes, infrastructure upgrades, and shifting lifestyle trends. Getting in early, and getting in smart, could make all the difference. Whether you’re a first-time investor or looking to expand your portfolio, now is the time to pay attention to LA’s rising neighborhoods. The opportunities are real and they’re already in motion.