Blog

Keep updated with recent real estate news.

How to Fund Your ADU Project: Grants, Loans, and Incentives

Accessory Dwelling Units (ADUs) are becoming a popular choice for homeowners looking to increase property value and generate rental income. Financing an ADU can seem challenging, but there are numerous grants, loans, and incentives available to make these projects more affordable. This guide will walk you through the top financing options and programs that can help turn your ADU plans into reality.

1. Understanding ADU Costs and Budgeting Basics

Building an accessory dwelling unit (ADU) can be a smart way to increase property value, generate rental income, or create flexible space for families. But before you start designing or pulling permits, you need a clear picture of what the project will cost and how to plan for it.

A realistic ADU budget should cover more than just construction. It should also include design fees, permitting costs, utility connections, site prep, and contingency funds for unexpected expenses. Depending on factors like size, site conditions, and location, total costs can range anywhere from $40,000 for a simple garage conversion to over $300,000 for a new detached unit.

The first step is outlining your ideal budget based on both what you want to build and how you plan to use it. If you’re thinking long-term such as generating rental income factor in potential return on investment (ROI), market rent rates in your area, and how the ADU fits into your overall property strategy.

A thoughtful budget not only helps you avoid financial surprises, it also keeps your project aligned with your goals from day one.

2. Exploring ADU Grants and Incentives by State and City

With the growing need for affordable housing, many states and cities including Los Angeles are offering financial incentives to help homeowners build accessory dwelling units (ADUs). These programs are designed to reduce upfront costs, simplify approvals, and make ADUs more accessible for everyday property owners.

In California, the state has supported various ADU initiatives, including grant programs that provide eligible homeowners with up to $40,000 to cover pre-construction costs like design, permits, site prep, and utility hookups. These grants are typically administered through approved lenders and housing agencies, and funding is limited so early application is key.

In Los Angeles, additional incentives exist to encourage ADU development:

- LA ADU Accelerator Program: Matches older adults in need of housing with homeowners willing to rent out their ADU at affordable rates, in exchange for guaranteed rent and landlord support.

- Streamlined permitting: The city has introduced policies to reduce processing time for ADU approvals, especially in single-family zones.

- Fee waivers and expedited review: Depending on the ADU type and neighborhood, certain development fees may be reduced or waived entirely.

Pro Tip: Check with the Los Angeles Housing Department (LAHD) and California Housing Finance Agency (CalHFA) for the most current grant opportunities and eligibility requirements. These programs change frequently, and staying updated ensures you won’t miss out on funding or time-saving options.

If you’re serious about building an ADU in Los Angeles, understanding and applying for local incentives could save you thousands and make your project more financially viable from the start.

3. Federal and State Loan Programs for ADU Development

Financing an accessory dwelling unit can be challenging, especially with rising construction costs in cities like Los Angeles. Fortunately, several federal and state-backed loan programs are designed to support ADU development by making financing more accessible and affordable.

Here are some key options:

FHA 203(k) Loan

The FHA 203(k) is a government-backed renovation loan that allows homeowners to refinance their existing mortgage and roll ADU construction costs into the new loan. This can be especially useful for those who want to build an ADU but don’t want to take out a second mortgage or high-interest personal loan. It covers structural work, permits, and other qualifying improvements.

Fannie Mae HomeStyle Renovation Loan

This loan works similarly to the FHA 203(k) but is offered through Fannie Mae. It allows homeowners to finance ADU construction or upgrades by bundling the costs into a new or refinanced mortgage. The HomeStyle loan offers more flexibility in terms of property types and improvements, making it a strong option for those who want to customize their ADU project.

CalHFA ADU Grant Program

Offered through the California Housing Finance Agency, this grant provides up to $40,000 to cover pre-development costs like site preparation, permits, and utility connections. It’s specifically designed to help low- and moderate-income homeowners overcome upfront barriers to ADU construction. Funds are typically disbursed through approved lenders and must be used in combination with a qualifying loan product.

Why These Programs Matter

Many of these financing options offer competitive interest rates, low down payments, and flexible repayment terms. They’re especially useful for homeowners who want to invest in an ADU as a source of rental income or multigenerational housing but need financial support to get started.

Tip: Work with a lender who understands ADU financing. Not all mortgage providers are familiar with how to structure these loans, so choosing the right partner is critical to avoid delays or missed opportunities.

By tapping into the right loan or grant program, you can reduce upfront costs, spread payments over time, and make your ADU project financially feasible without compromising your long-term goals.

4. Municipal ADU Financing Programs in Los Angeles

In an effort to increase affordable housing, Los Angeles and Los Angeles County have launched local financing programs that support homeowners interested in building accessory dwelling units (ADUs). These programs are designed to reduce the financial barriers to entry particularly for those willing to offer long-term or income-restricted rentals.

Los Angeles County ADU Pilot Program

This initiative provides financial assistance to eligible homeowners who agree to rent out their ADUs at affordable rates. The program may offer low-interest loans or forgivable loan options to help cover construction costs, with the condition that the unit remains affordable for a set number of years.

While funding is limited and competitive, it’s a viable option for property owners interested in contributing to affordable housing goals while also generating rental income.

City of Los Angeles Supportive ADU Programs

While the City of Los Angeles does not currently offer direct ADU construction loans, it supports affordability-focused initiatives such as the LA ADU Accelerator Program, which matches homeowners with older adults in need of housing. In return, homeowners receive guaranteed rent and landlord support in exchange for offering their ADU at below-market rates.

5. Alternative Financing Options for ADU Projects

If grants and government-backed loans don’t fully cover your ADU costs, there are several private financing options that can help bridge the gap. These alternatives allow you to tap into your home’s existing value or restructure your mortgage to fund construction. Each option comes with trade-offs, so understanding how they work is key to making the right decision for your financial situation.

Home Equity Loan (HEL)

A home equity loan allows you to borrow a lump sum based on the equity you’ve built in your home. These loans typically come with fixed interest rates and consistent monthly payments, making them a reliable choice if you have a clearly defined construction budget. They work well for homeowners who want predictability and plan to complete the ADU project in a single phase.

Home Equity Line of Credit (HELOC)

A HELOC works more like a credit card, giving you a revolving line of credit that you can draw from as needed. You’ll only pay interest on the amount you use. This is ideal for ADU projects with flexible timelines or phased construction. Keep in mind, interest rates are usually variable, so monthly payments may fluctuate over time.

Cash-Out Refinance

With a cash-out refinance, you replace your current mortgage with a new, larger loan and take the difference in cash. This can be a good option if you can secure a lower interest rate or want to consolidate your debt into a single monthly payment. It’s often used by homeowners who have seen significant property appreciation common in many Los Angeles neighborhoods.

Choosing the Right Option

Each financing method has different implications for your mortgage, interest rates, and monthly obligations. Before choosing one, consider:

- Your current home equity and credit profile

- How soon you need the funds

- Whether your ADU will be used for rental income, family use, or resale value

- Interest rate trends and your tolerance for variable rates (in the case of HELOCs)

It’s also wise to consult a mortgage advisor or financial planner familiar with ADU projects in Los Angeles. A well-chosen financing strategy can make your project more affordable and more aligned with your long-term financial goals.

6. Leveraging Tax Incentives and Rebates for ADU Projects

Beyond grants and loans, tax incentives and rebates can play a valuable role in reducing the overall cost of building an accessory dwelling unit (ADU). By incorporating energy-efficient and sustainable features, Los Angeles homeowners may qualify for a range of local, state, and federal financial benefits while also improving long-term property value.

Federal Tax Credits

The federal government offers tax credits for energy-efficient upgrades under programs like the Residential Clean Energy Credit. If you install eligible features such as solar panels, solar water heaters, or geothermal systems in your ADU, you may be able to deduct a portion of the installation cost from your federal taxes up to 30% in some cases.

California State Energy Rebates

California offers additional incentives through programs like GoGreen Home and TECH Clean California, which provide rebates for using energy-efficient appliances, heat pump water heaters, insulation, and smart thermostats. These rebates are open to homeowners who build or upgrade units using eco-friendly construction materials or energy-saving systems.

Los Angeles-Specific Programs

Locally, the Los Angeles Department of Water and Power (LADWP) offers rebates for installing low-flow plumbing fixtures, high-efficiency toilets, and Energy Star-certified appliances. Some programs also apply to turf replacement, greywater systems, and other sustainable landscaping features often integrated into new ADU builds.

7. Combining Financing Methods for a Cost-Effective ADU Strategy in Los Angeles

In a high-cost city like Los Angeles, successfully funding an ADU often means using more than one financing tool. Homeowners who combine grants, loans, and tax incentives are more likely to stay on budget and get the most value from available programs.

For example, you might:

- Start with a CalHFA ADU Grant to cover upfront expenses like site prep, design, and permits up to $40,000 in assistance for eligible homeowners.

- Use a HELOC or home equity loan to finance the core construction costs, allowing for flexibility and potentially lower interest rates.

- Apply for LADWP rebates for water- and energy-efficient fixtures, and take advantage of federal tax credits if you install solar panels or other renewable systems.

- Explore the LA County ADU Pilot Program if you’re willing to offer the unit as affordable housing for a set period, which could qualify you for low-interest or forgivable financing.

8. Calculating the ROI of Your ADU Investment in Los Angeles

Building an ADU isn’t just a housing decision it’s a financial one. Whether you’re planning to rent it out or use it for family, understanding the return on investment (ROI) can help you decide how much to spend and how to finance it.

Here are two major ways an ADU can pay off in Los Angeles:

Increased Property Value

In LA’s competitive housing market, adding a legal ADU can significantly boost your home’s resale value. Studies show that ADUs can increase a property’s value by 20–30%, especially in high-demand neighborhoods like Silver Lake, Highland Park, or West Adams where additional living space is highly desirable.

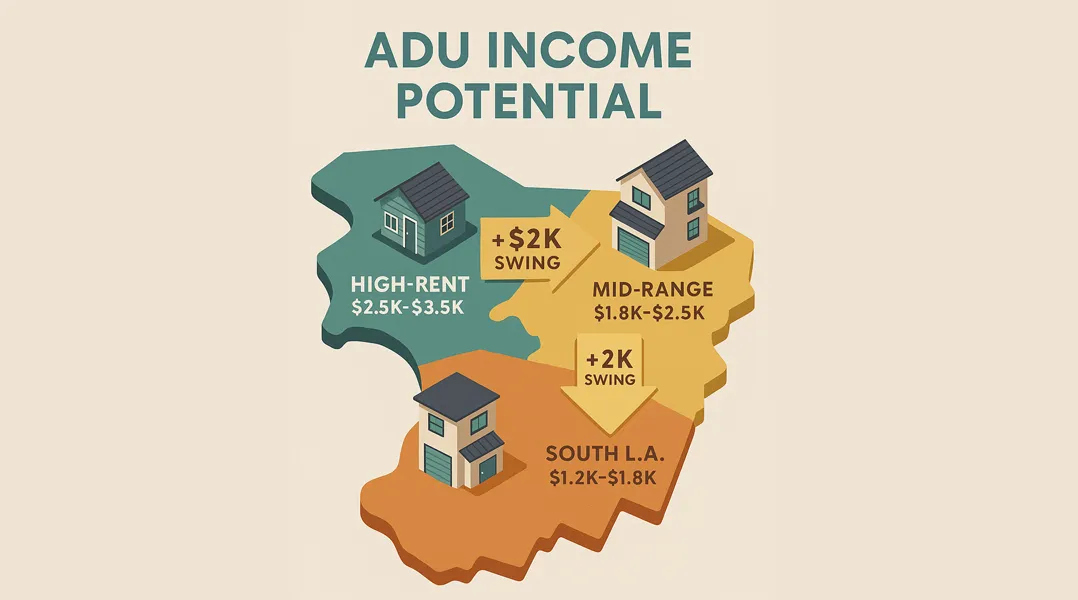

Rental Income Potential

With high rental demand across Los Angeles, a well-designed ADU can generate steady monthly income. Depending on location, size, and features, ADUs in LA commonly rent for $1,500–$3,000 per month. That income can help cover your mortgage, repay construction loans, or even turn into long-term profit once financing is paid off.

How to Estimate ROI

To get a clear sense of return, factor in:

- Construction and financing costs (including loans, permits, and utilities)

- Ongoing expenses (maintenance, insurance, property taxes)

- Expected rental income based on local market rates

- Long-term appreciation based on ADU resale value projections

You can also speak with a local real estate agent or property manager to estimate rental rates and resale impact in your neighborhood.

9. Use Local Property Data to Make Smarter ADU Decisions in Los Angeles

In a complex and competitive market like Los Angeles, building an ADU without the right data can lead to costly mistakes. Whether you’re trying to estimate rental income, confirm zoning regulations, or understand your property’s limitations, using accurate, up-to-date property data is essential to making informed choices.

Comparative Market Analysis (CMA)

Before you price your ADU for rent or evaluate your return on investment, it’s important to conduct a CMA. This analysis compares your property with similar homes in the same neighborhood to estimate:

- Current property value

- Rental income potential for your ADU

- Buyer or tenant demand in your area

Los Angeles real estate markets vary significantly by neighborhood, so knowing how ADUs are performing in places like Echo Park vs. North Hollywood can make a big difference in your financial planning.

Parcel-Specific Property Evaluation

Go beyond basic online listings. Use tools that provide parcel-level insights into:

- Zoning and land use regulations

- Setbacks and buildable area

- Permit history and open code violations

- Fire zone status, overlays, and environmental restrictions

- Utility line locations and infrastructure constraints

This level of detail helps you identify whether your lot can realistically support an ADU and where you may run into challenges.

Financing Your Path to a Value-Added ADU in Los Angeles

Adding an accessory dwelling unit is one of the most effective ways to boost your property’s value, create passive income, and add flexibility to your living space whether it’s for multigenerational housing, long-term rental, or future resale.

Thanks to a growing number of grants, low-interest loans, tax incentives, and local financing programs, building an ADU in Los Angeles is more achievable than ever before. But success depends on more than just accessing funding. It requires strategically combining the right mix of financial tools and aligning them with your property’s specific conditions, zoning regulations, and long-term goals.

By taking time to:

- Understand local permitting and zoning rules

- Use accurate property data to assess feasibility

- Explore and apply for relevant grants and rebates

- Choose the best financing method for your budget and timeline

- Consider your expected return on investment

You can build an ADU that not only fits your needs but also strengthens your financial future. With the right planning and informed decision-making, your ADU can be more than just extra space, it can be a high-performing asset that adds long-term value to your Los Angeles property.