Blog

Keep updated with recent real estate news.

How to Turn Your Home into an Investment Property Without Breaking the Bank

In today’s housing market, more and more homeowners are finding creative ways to turn their properties into income-generating assets. Whether it’s renting out a spare room, converting unused spaces, or building small additions, the possibilities are endless. Yet many people assume that transforming their home into an investment property requires a massive budget or a complete overhaul.

The truth? With the right strategy and a focus on cost-effective upgrades, you can unlock your home’s potential without breaking the bank. From simple renovations to smart planning, this guide will show you practical ways to start earning passive income, boosting your property’s value, and turning your home into a smart investment. This guide breaks down how you can take small, practical steps to turn your property into a valuable income source, starting with why this strategy makes sense for homeowners.

Section 1: Assessing Your Home’s Investment Potential

Before diving into renovations or listing your property, it’s essential to understand what makes your home an attractive investment. Assessing your property’s strengths and opportunities will help you identify the best income-generating strategy while keeping costs manageable.

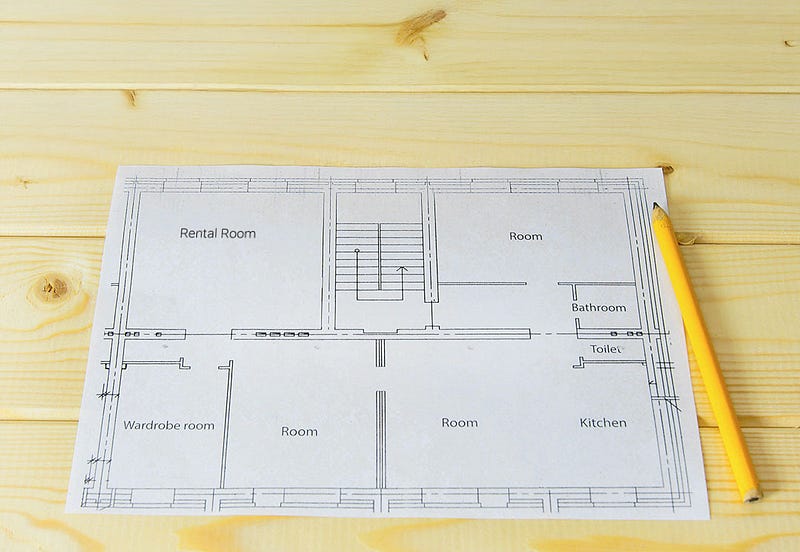

1.1 Understanding Your Space

Start by evaluating the space you currently have:

- Spare Rooms or Basements: A spare bedroom, attic, or basement can be transformed into a rental space with minimal changes, such as adding basic furnishings, a private entrance, or a small kitchenette.

- Unutilized Structures: Garages, sheds, or outbuildings can be converted into functional spaces like short-term rental units or home offices.

- Yard Space: If your backyard has room, consider building an Accessory Dwelling Unit (ADU), which can be a small investment that yields big returns.

Tip: Take stock of what’s available and what can be upgraded with minor tweaks?—?every square foot has potential.

1.2 Researching Local Demand

The success of your home as an investment depends on market demand. Ask yourself:

- Is your neighborhood popular for short-term rentals like Airbnb?

- Are you near schools, hospitals, or workplaces where long-term renters may be looking for housing?

- Is there a demand for affordable housing units or ADUs in your area?

Research rental rates for properties similar to yours to determine your earning potential. Platforms like Zillow or Airbnb can give you insights into what renters are willing to pay.

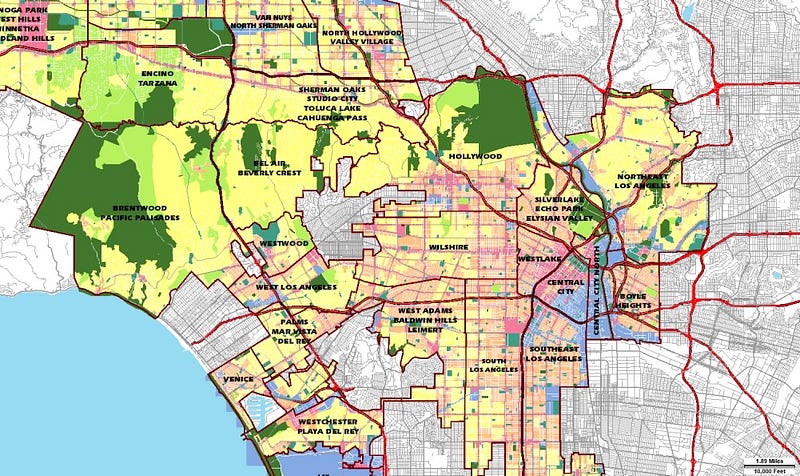

1.3 Checking Local Zoning and Regulations

Before making changes, ensure your plans align with local rules:

- Zoning Laws: Check if you’re permitted to add an ADU or rent out spaces on your property.

- Short-Term Rental Regulations: Many cities, including Los Angeles, have specific rules regarding short-term rentals.

- Permits: Renovations like basement conversions, ADUs, or garage rebuilds often require permits.

Tools like Terrakan simplify the early stages of property planning by offering zoning insights, ROI calculations, and feasibility reports. With actionable data, Terrakan helps you uncover your property’s potential and make informed decisions. By assessing your current space, understanding market demand, and ensuring legal compliance, you’re well on your way to transforming your property into an income-generating asset. Next, let’s explore practical, cost-effective ways to start generating income from your home.

Section 2: Start Small?—?Cost-Effective Ways to Generate Income

Transforming your home into an income-generating property doesn’t require breaking the bank. With small, practical changes, you can start seeing returns on your investment without a major financial overhaul. Here are a few budget-friendly strategies to begin with:

2.1 Convert an Extra Room or Basement into a Rental

One of the quickest and most affordable ways to generate income is by renting out a spare room, basement, or unused space within your home. Here’s how to get started:

Minimal Renovations: You don’t need to undertake a major remodel?—?simple, low-cost upgrades can make the space appealing:

- Fresh paint to brighten the room.

- Add basic furnishings like a bed, desk, and storage.

- Provide amenities renters value, such as high-speed Wi-Fi, a mini-fridge, and private access if possible.

Short-Term Rental Platforms: Platforms like Airbnb and VRBO allow homeowners to easily list their spaces for short-term stays, making this an excellent option for locations near popular attractions, workplaces, or travel hubs.

- Flexibility: Short-term rentals give you control over availability?—?you can rent out the space only when it’s convenient for you.

- Higher Returns: Nightly rates often yield higher income compared to long-term leases.

Tip: Keep the space clean, well-lit, and stocked with essentials to attract positive reviews and repeat bookings.

2.2 Build an ADU (Accessory Dwelling Unit)

Building an ADU?—?whether a detached unit, garage conversion, or interior conversion?—?offers a long-term investment with significant financial rewards.

- What Is an ADU?: An ADU is a small, secondary housing unit built on your existing property. Common ADU types include:

- Garage Conversions: Repurpose an existing garage into a livable unit.

- Interior Conversions (JADUs): Transform basements, attics, or other underutilized spaces.

- Prefab ADUs: Prefabricated units are cost-effective and quicker to install.

- Why ADUs Are Worth It: While ADUs require an initial investment, they can generate steady rental income for years to come. For homeowners, they are a practical way to increase property value and ROI without requiring new land.

How Terrakan Can Help: Identifying ADU opportunities doesn’t have to be complex. Terrakan can assist with:

- Zoning insights to determine if your property qualifies for an ADU.

- ROI calculations to show you how quickly your ADU investment will pay off.

- Navigating permits and local regulations to streamline the process.

Stat: In Los Angeles, ADUs are one of the most popular ways homeowners are adding income streams while helping alleviate the housing shortage.

2.3 Use Your Backyard for Unique Income Streams

Your backyard can be more than just a green space?—?it can be a creative source of income with minimal investment.

Rent It Out for Events: If you have a well-maintained yard or a scenic garden, consider renting it out for:

- Small weddings or private parties.

- Outdoor workspace rentals for remote workers seeking a peaceful, open environment.

- Photo shoots, yoga classes, or pop-up events.

Set Up Micro-Housing: Install small prefab units, tiny homes, or garden cottages in your backyard. These units are cost-effective and appeal to renters seeking affordable, unique housing options.

- Micro-housing is particularly popular for short-term stays or creative workspaces.

- Units can be marketed as retreats for travelers, artists, or professionals.

Tip: Use platforms like Peerspace or Splacer to list your backyard for events or creative uses. Adding small touches like outdoor seating, lighting, or a fire pit can increase its appeal.

By starting small with these cost-effective strategies?—?whether it’s converting an extra room, exploring ADU opportunities, or making creative use of your backyard?—?you can turn your home into a reliable income stream. Starting small can be budget-friendly, but what if you need additional funding for larger upgrades like an ADU? Let’s look at accessible ways to finance your property transformation without overextending your budget.

Section 3: Funding Your Investment Property Without Breaking the Bank

Turning your home into an investment property doesn’t have to mean draining your savings. There are smart, accessible ways to fund upgrades and improvements that maximize your return without putting you in financial stress. Here are key strategies to finance your transformation:

3.1 Home Equity Loans or HELOCs

If you’ve built up equity in your home, a Home Equity Loan or Home Equity Line of Credit (HELOC) can be an excellent financing option for renovations or additions.

How It Works:

- A Home Equity Loan allows you to borrow a lump sum of money based on your home’s current equity.

- A HELOC works like a revolving credit line, giving you the flexibility to borrow what you need, when you need it.

Why It’s Budget-Friendly:

- Lower interest rates compared to personal loans or credit cards.

- Funds can be used for cost-effective upgrades, like building an ADU or renovating a spare room into a rental.

Pro Tip: Use HELOC funds in phases?—?start with smaller, high-return improvements like fresh paint and furnishings, and scale up to bigger projects like ADU construction as income rolls in.

3.2 Grants and Local Programs

Did you know there are local incentives and programs that can help fund your home transformation? Many cities, including Los Angeles, offer grants and financial support for specific types of projects:

ADU Incentive Programs: Several local governments provide funding or waived fees for building Accessory Dwelling Units to increase housing availability. Check for:

- ADU grants that cover planning, permitting, or construction costs.

- Loan programs specifically designed to help homeowners finance ADU projects.

Energy-Efficient Upgrades: Programs like energy-efficiency rebates and tax credits can help offset the cost of eco-friendly improvements, such as:

- Installing solar panels.

- Upgrading insulation or energy-efficient windows.

- Adding water-saving fixtures like low-flow toilets or smart irrigation systems.

How to Start: Research local housing or sustainability departments to find current grants and incentives in your area. Partnering with services like Terrakan can help you navigate zoning laws and identify qualifying projects.

3.3 Budget-Friendly Renovations

You don’t need a massive renovation budget to create a rentable space that tenants will love. Here are practical, cost-conscious upgrades to boost your property’s appeal:

DIY Upgrades: Small changes can have a big impact when done thoughtfully. Start with:

- Painting: A fresh coat of neutral-colored paint makes rooms feel brighter, cleaner, and more inviting.

- Flooring: Replace worn carpets with cost-effective laminate or vinyl flooring for a modern look.

- Lighting: Swap outdated fixtures with affordable, energy-efficient lighting options.

Furnishing on a Budget: If you’re offering a furnished rental, focus on affordable yet functional furniture and décor:

- Mix budget-friendly finds from stores like IKEA, Wayfair, or second-hand shops with stylish accents like rugs, throw pillows, and wall art.

- Add key amenities that renters value, such as smart TVs, fast Wi-Fi, and cozy bedding.

Pro Tip: Stick to a consistent, minimal design aesthetic to appeal to a wide range of tenants and reduce long-term upkeep costs.

By leveraging home equity, tapping into local funding programs, and sticking to budget-friendly renovations, you can transform your property into an investment asset without overspending. Whether it’s accessing grants for ADUs or taking on simple DIY projects, smart financing ensures your upgrades remain affordable while delivering strong returns. Once your upgrades are complete, the next step is managing your property efficiently to maximize returns. Here are some tips to streamline management and keep operations stress-free.

Section 4: Managing Your Investment Property Like a Pro

Once your investment property is ready to generate income, effective management becomes the key to ensuring long-term success. Whether you’re renting out a spare room, an ADU, or backyard space, smart property management will keep operations smooth, tenants happy, and profits consistent. Here are practical tips to manage your property like a pro, without overwhelming your schedule or budget.

4.1 Use Apps and Tools to Streamline Management

Gone are the days of juggling paperwork and chasing down rent checks. Today’s tech tools simplify property management and save time for homeowners looking to generate passive income.

- Tenant Screening: Apps like Zillow Rental Manager and Avail make tenant screening easy, allowing you to check rental histories, credit scores, and references before signing a leas

- Rent Collection: Automate rent payments with tools like PayRent, Rentec Direct, or Buildium, which allow tenants to pay online and send reminders for missed payments.

- Maintenance Scheduling: Platforms like TaskRabbit or Thumbtack connect you with local professionals to handle repairs, cleaning, or routine maintenance on short notice.

Pro Tip: Automating repetitive tasks like rent collection and maintenance requests reduces stress and ensures nothing slips through the cracks.

4.2 Leverage Short-Term Rental Platforms for Flexibility

If you’re not ready to commit to a long-term tenant, short-term rental platforms like Airbnb or VRBO provide a flexible way to generate income:

- Why It Works: Short-term rentals often earn higher income per night compared to traditional leases, especially in high-demand areas like Los Angeles.

- Key Considerations

- Furnish the space thoughtfully to appeal to vacationers, business travelers, or temporary residents.

- Offer standout amenities like Wi-Fi, smart TVs, or a stocked kitchenette to attract bookings.

- Set competitive pricing by researching similar listings in your area.

- Managing Bookings: Tools like Guesty or Lodgify help automate bookings, calendar syncing, and guest communication across multiple platforms.

Pro Tip: Keep a clear calendar for personal use or unexpected needs so your space remains flexible.

4.3 Hire Part-Time Property Managers for Stress-Free Oversight

If the thought of managing tenants, maintenance, or bookings feels overwhelming, a part-time property manager can provide valuable oversight without the cost of full-time services.

- What They Handle:

- Screening tenants or managing short-term rental guests.

- Handling maintenance calls and scheduling repairs.

- Ensuring rent payments or bookings stay on track.

- Affordable Options: Many property managers offer hourly or task-based rates, allowing you to delegate only what you need?—?whether it’s guest check-ins, repairs, or tenant communication.

Pro Tip: Hiring a local property manager with experience in short-term or ADU rentals can be a game-changer, freeing up your time while ensuring your property runs efficiently.

By incorporating these tools and strategies, managing your investment property doesn’t have to be a full-time job. Automating key tasks, leveraging short-term rental platforms, or hiring part-time help allows you to enjoy stress-free income while maintaining high tenant satisfaction. While managing your property is key, staying compliant with legal and zoning requirements is equally important to avoid setbacks. Let’s dive into the key legal considerations every homeowner should know.

Section 5: Key Legal and Zoning Considerations

Before diving into turning your home into an income-generating property, it’s essential to understand the legal and zoning landscape. Navigating local laws ensures you stay compliant, avoid fines, and set yourself up for long-term success. From zoning requirements to tax implications, here’s what every homeowner should know.

5.1 Check Local Zoning Laws and Rental Regulations

Zoning laws can determine whether you’re allowed to build an ADU, convert a garage, or rent out a spare room in your home. Each city or county has specific requirements, so doing your homework early is critical.

Short-Term Rentals: Cities like Los Angeles require homeowners to apply for short-term rental permits when listing spaces on platforms like Airbnb or VRBO. Some areas may also limit the number of rental days per year.

ADU Regulations: Many municipalities have embraced ADUs but still enforce rules regarding:

- Lot size and setbacks.

- Maximum unit size (e.g., 1,200 sq ft in Los Angeles).

- Parking requirements or exemptions.

HOA Restrictions: If you live in a homeowners’ association, review their rules regarding rentals and property modifications to avoid conflicts.

Tip: Tools like Terrakan can simplify zoning research by providing clear insights into your property’s ADU feasibility, including setback rules, lot restrictions, and allowable unit sizes.

5.2 Understand Tax Implications of Rental Income

Renting out part of your home comes with financial benefits?—?but it also brings tax responsibilities. Knowing how rental income is taxed and what expenses you can deduct will help you stay compliant while maximizing your profits.

- Rental Income: All rental earnings must be reported as income on your tax return. Whether short-term or long-term, the IRS treats this income the same.

- Deductible Expenses: Reduce your tax burden by deducting rental-related expenses, such as:

- Mortgage interest and property taxes.

- Utilities, maintenance, and repairs.

- Depreciation of the rented space.

- Advertising costs for listings.

- Short-Term Rental Considerations: If you rent out a space for fewer than 14 days per year, you may qualify for a tax exemption under the “14-Day Rule,” depending on your situation.

Tip: Consult a tax professional to ensure you’re maximizing deductions and following all IRS guidelines for rental income reporting.

5.3 Leverage Tools Like Terrakan for Compliance

Ensuring your property complies with zoning laws and feasibility requirements doesn’t have to be overwhelming. Tools like Terrakan streamline the process, offering homeowners:

- Zoning Analysis: Quickly determine whether your property qualifies for an ADU or rental conversion based on local regulations.

- Feasibility Reports: Assess your lot size, setbacks, and infrastructure to determine the most cost-effective and compliant way to proceed.

- ROI Insights: Estimate rental income potential and calculate return on investment to make informed decisions about your upgrades or conversions.

By leveraging tools like Terrakan, you can confidently move forward with your plans, knowing your project aligns with local requirements and offers a solid return on investment.

Final Tip: Legal compliance is the foundation of a successful rental property. By understanding zoning laws, rental regulations, and tax responsibilities upfront, you’ll avoid headaches down the road and position your property for long-term profitability.

With a solid understanding of legal requirements and zoning rules, you’re ready to confidently move forward. Let’s recap how to turn your home into a thriving investment property.

Final Thoughts

Turning your home into an investment property is a smart way to maximize its value and generate income. By starting with small upgrades, securing creative funding, and leveraging tools like Terrakan, you can confidently transform your property into a valuable asset. The journey might begin with one room, but the rewards can shape your future for years to come.

The key is to focus on cost-effective upgrades, leverage creative financing solutions, and plan for long-term gains. Whether you’re tackling DIY projects, managing rentals like a pro, or ensuring zoning compliance, thoughtful planning can turn your vision into a reality.

Tools like Terrakan make the process even easier by providing zoning insights, ROI calculations, and feasibility reports?—?helping you maximize your property’s potential without guesswork.