Blog

Keep updated with recent real estate news.

Smart Real Estate Strategies for a Volatire Housing Market

The Contradiction of Building During a Downturn

At first glance, starting a development project during a recession might seem risky. Economic downturns often lead to tighter lending conditions, weakened consumer confidence, and an overall slowdown in real estate activity.

But smart investors know better. During the Great Recession (2007–2009), U.S. housing starts dropped from over 2 million units in 2005 to just 554,000 in 2009?—?a staggering 73% decline

(Pew Research).

When others pull back, experienced builders start laying groundwork. Because entitlement, permitting, and construction take time, projects initiated during a recession often reach completion during the next upswing?—?when demand returns and competition tightens.

The key isn’t just about timing. It’s about knowing exactly what the land can support, what’s legally feasible, and where opportunities are hiding in plain sight. (St Louis FED)

The Long Game: Why Timing the Recovery Starts During the Recession

Permitting and entitlement can take 12 to 24 months. When you factor in architectural design, financing, approvals, and construction, most developments span multiple market cycles.

This is why developers who move first?—?when others are paralyzed?—?often exit strongest.

During the 2008 housing crash, builders who secured lots and permits in 2010–2011 saw major gains when their projects hit the market in 2013–2014. Delaying meant missing that rebound.

You don’t win in real estate by reacting to headlines. You win by planning for what happens next?—?and being ready when it does. (National Association of Home Builders)

Cost Advantages of Building in a Down Market

When the market slows, developers gain leverage. Here’s why:

- Land prices decline, especially for underutilized or overlooked parcels

- Labor availability improves as speculative projects stall

- Material costs may soften due to reduced global demand

- Permitting departments often move faster with fewer applications to process

This environment allows builders to move efficiently?—?if they have clarity on zoning, overlays, and feasibility. (Lumber)

Why Zoning Matters More Than Ever in a Recession

When home prices flatten, your upside depends on how much value you can create. And that starts with zoning.

Zoning laws determine:

- What you can build (ADUs, duplexes, small-lot subdivisions)

- How much you can build (FAR, density, unit count)

- What risks exist (fire, slope, hillside overlays)

Many people overlook zoning because they think it’s static. But zoning changes all the time especially in cities trying to address housing shortages.

A report by McCoy Valuation shows how upzoning and expanded land use permissions directly increase property value. In a recession, understanding zoning may be the difference between sitting on a lot and unlocking its full development potential.

Examples of High-Value Projects Even in a Downturn

During economic downturns, certain real estate development strategies can offer resilience and long-term value. Here are some approaches that have demonstrated potential:

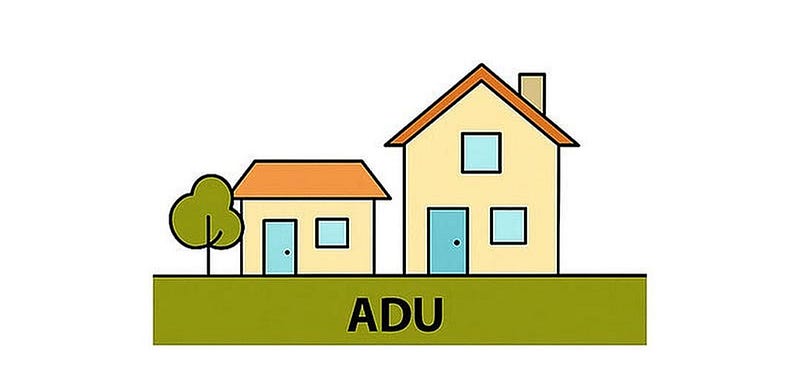

Accessory Dwelling Units (ADUs)

ADUs are secondary housing units on single-family lots. They provide additional rental income and increase housing supply without altering neighborhood character. The Terner Center for Housing Innovation highlights that ADUs are cost-effective to build and can help homeowners, especially seniors, maintain financial stability. ?(Regional Plan Association)

Small-Lot Subdivisions

This strategy involves dividing larger residential lots into smaller parcels to build multiple housing units, such as townhomes. Thesis Driven discusses how small-lot subdivisions can increase urban density and provide more affordable housing options. ?(Thesis Driven)

Conversions of Underutilized Properties

Transforming existing structures, like large single-family homes, into multi-family units can maximize property use. The Regional Plan Association notes that such conversions can create additional housing units and better meet community needs. ?(Regional Plan Association)

Teardown and Rebuild in Relaxed Zoning Areas

In areas where zoning laws have been updated to allow higher density, demolishing outdated structures to build new, multi-unit housing can be profitable. The National Association of Home Builders provides insights into how zoning changes can facilitate such developments. ?(National Association of Home Builders)

Smart Investment Strategies During a Recession

Economic downturns can present unique opportunities for real estate investors who adopt strategic approaches. By focusing on resilient asset classes and implementing prudent investment practices, investors can navigate recessions effectively. Here are some strategies to consider:

Focus on Income-Producing Properties

Investing in properties that generate consistent rental income can provide stability during economic fluctuations. Income-producing real estate, such as rental properties, can continue to generate rental income even during downturns. In fact, housing markets often suffer during recessions, leading more people to turn to renting, which can keep rental markets buoyant. ?(Entrust Group)

Diversify Your Real Estate Portfolio

Diversification across different property types and geographic locations can mitigate risk. For instance, combining investments in residential, commercial, and industrial properties across various markets can cushion the impact of localized economic downturns. Diversifying your property types can help spread out your risk. ?(Commercial Real Estate Loans)

Consider Real Estate Investment Trusts (REITs)

REITs offer exposure to real estate markets without the need to directly manage properties. They can provide liquidity and diversification benefits. REITs are known for their dividend payouts and are expected to outperform private equity real estate and stocks in 2023 amidst high interest rates and recession fears. ?(Investopedia)

Maintain Adequate Cash Reserves

Having sufficient liquidity allows investors to capitalize on opportunities that arise during market downturns, such as purchasing undervalued properties. Increasing your cash reserves can help protect your investments during a recession. ?(Commercial Real Estate Loans)

Final Takeaway: Build Smart, Not Fast

Recessions don’t scare experienced investors they create space to move.

When others pull back, there’s less competition for land, permits, and labor. But acting early doesn’t mean rushing. It means moving with clarity and purpose.

Terrakan helps investors decode zoning, overlays, and buildability before the recovery begins.

By offering detailed zoning data, overlay analysis, and build feasibility tools, Terrakan gives you the clarity to act while others wait. Whether you’re evaluating a teardown, adding an ADU, or seeking hidden value in hillside parcels, zoning intelligence turns speculation into strategy.

Markets will recover. But the strongest positions are claimed before that happens.

Build smart, not fast. Start with knowledge. Start with Terrakan.