Blog

Keep updated with recent real estate news.

The Rise of Co-Living Spaces: Is It the Right Investment for You? (And How ADUs Can Increase Property Value)

With rising housing costs and shifting lifestyle preferences, alternative living arrangements are gaining momentum. Co-living spaces and Accessory Dwelling Units (ADUs) have emerged as practical solutions that maximize rental income and optimize urban housing. For investors, these trends present exciting opportunities to diversify portfolios and boost property value. But are they the right investment for you? Let’s explore the profitability, benefits, and challenges of co-living spaces and ADUs.

Market Growth and Demand

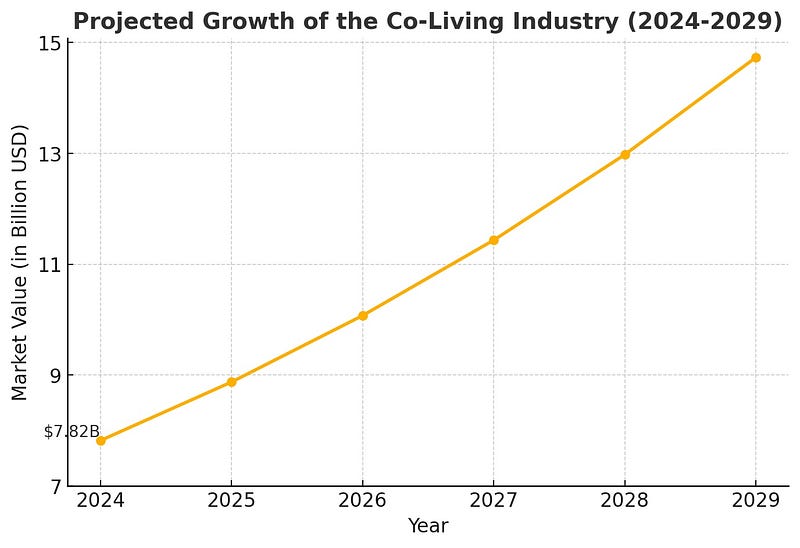

Co-living spaces have experienced rapid growth, particularly in high-cost urban areas. The industry was valued at approximately $7.82 billion in 2024 and is projected to expand at a CAGR of 13.5% over the next five years. (Grand View Research)

What’s fueling this surge? The demand comes largely from millennials, Gen Z professionals, and remote workers who value affordability, flexibility, and built-in community experiences. Startups like Common, Bungalow, and Outsite have capitalized on this shift, offering co-living accommodations tailored to this evolving demographic. (Bigger Pockets)

Benefits for Investors

- Higher Rental Yields: Co-living properties generate 15–30% more revenue than traditional rentals because multiple tenants contribute to rental income.

- Lower Vacancy Rates: The demand for affordable urban housing keeps co-living spaces occupied with minimal downtime?—?often with vacancy rates below 5%.

- Scalability: Investors can repurpose existing multi-family homes or large single-family residences into co-living properties, increasing income without the need for major redevelopment. (Nev Estate)

The Impact of ADUs on Property Value

Financial Advantages

For homeowners and real estate investors, ADUs are a game-changer. Studies show that homes with permitted ADUs sell for 35% more than comparable properties without them?—?particularly in cities with housing shortages like Los Angeles and San Francisco. (Better Place Design Build)

Beyond resale value, ADUs offer flexible rental income opportunities. They can serve as long-term rentals, short-term Airbnb units, or private guest suites, making them an excellent addition for homeowners looking to generate extra cash flow. (EZ Plans)

Legislative Support

One of the biggest advantages of ADUs is the growing government support for their development. In California, recent zoning law changes have eased restrictions on ADU construction, making it simpler and more affordable for homeowners to build these units. As cities push for more housing density, ADUs are quickly becoming a staple of urban real estate investment. (SF Gate)

Strategic Considerations for Investors

Investment Strategies

- Market Research: Identify cities with high rental demand, strong job markets, and favorable zoning laws.

- Operational Management: Running a co-living space requires streamlined tenant management, clear lease structures, and community engagement. (Nev Estate)

- Regulatory Compliance: Every city has different rules regarding occupancy limits, rental agreements, and shared housing requirements?—?ensure compliance before investing.

ADU Development Planning

- Cost-Benefit Analysis: Weigh construction costs against potential rental income and long-term appreciation.

- Sustainable Design: Modern tenants favor energy-efficient and aesthetically pleasing ADUs?—?prioritize sustainability for higher demand.

- Zoning & Permits: Research local ADU regulations to streamline approvals and avoid unexpected roadblocks. (SF Bay ADU)

Final Thoughts

Both co-living spaces and ADUs offer compelling opportunities for investors looking to maximize property value and rental income. Co-living spaces provide higher short-term returns with multiple tenants, while ADUs offer long-term stability and asset appreciation.

Choosing the right investment depends on your goals, market conditions, and risk tolerance. By leveraging these trends and making informed, data-driven decisions, investors can position themselves for long-term success in the evolving real estate market.